Central Economic Plan (CEP) 2015

CPB has analysed alternatives for capital gains tax

Households that own large capital appear to be able to achieve relatively high returns, because a larger share of their capital consists of assets with high long-term returns. The added advantages of taxing capital gains are that it works according to the ability-to-pay principle and would have a more stabilising effect on the economy. Disadvantages are the less stable level of revenue and a more complicated implementation. However, there also are other alternatives, as described in the Central Economic Plan 2015 (CEP) that is published today by CPB Netherlands Bureau for Economic Policy Analysis.

The CEP’s main figures were already published on 5 March. Today, the full report has become available, presenting the purchasing power figures for 2015 and 2016 in greater detail. Median purchasing power will increase this year by 1.2%, thanks to low inflation and declining pension fund premiums. The working population will benefit the most (1.6%). Pensioners benefit the least, by 0.7%, as their pensions are only partly indexed. There will be no median increase in purchasing power in 2016. With 0.3%, the working population again will gain the most. Pensioners will lose 1.3%, as a result of limited indexation of pensions as well as government policy.

The CEP, traditionally, contains a number of ‘frames’ within which certain subjects or issues are discussed. The central issues this year are: the quantitative easing by the European Central Bank, the fan charts that show the projections’ uncertainty levels, the rising asset prices, the recapitalisation of banks, the Dutch deficit reduction from an international perspective, and the revenues from natural gas sales.

The macroeconomic main data are as follows (read the press release of 5th March 2015). Economic growth is projected to increase this year to 1.7% and next year to 1.8%. The euro’s decline against the dollar, together with the sizeable drop in oil prices, has a positive effect on the Dutch economy. Recovery is steady and this year also supported by domestic spending. Employment increases substantially, but unemployment will only drop slightly, to 7% in 2016. Inflation will remain low, in line with European price developments. Consumption, company profits and investments, on balance, all receive an impulse from the low level of inflation. The budget deficit will decrease to 1.8% this year and 1.2% next year. The structural EMU balance, corrected for the economy and incidents, will be -0.5% of GDP in both 2015 and 2016. For both years this will be at the same level as the medium-term objective of the EMU balance (MTO), according to European budgetary regulations.

Go directly to the Data.

Read the accompanying press release or go directly to the main indicators.

Related

- Centraal Economisch Plan 2015 (Dutch)

- Background Document (Assessment of the technical assumptions)

Downloads

Open data

Het CPB stelt "Open data" beschikbaar in de vorm van te downloaden databestanden.

Met het beschikbaar stellen van "Open data" starten we met:

- Ramingsdata (MEV 2016 en CEP 2015)

Assessment of the technical assumptions on exchange rates, oil prices and interest rates (CEP2015)

This CPB Background Document accompanies the Central Economic Plan 2015 (translation of chapter 1).

These four variables are being used as exogenous inputs in projections of the world economy and of the Dutch economy.

First we present a short overview of the theory and the projection methods applied in the literature and used by international organizations. Then we compare the average forecast error of projection based on a random walk with the forecast error of projections based on futures or swaps. We conduct this analysis on historical data and calculate the forecast errors out-of-sample one to eight quarters ahead. We also examine whether it makes a difference whether we use the data from the last day before the projections are made, or the average over the past week, two weeks, month or quarter.

Finally we explain our future modelling choice, which we make based on three criteria: forecasting accuracy, internal consistency and tractability, and compatibility with the literature and international common practice.

Downloads

Authors

Het financieel vermogen in box-3: verdeling en belasting

Lees het Centraal Economisch Plan 2015.

Allereerst bespreekt paragraaf 2 een aantal aanvullende analyses over de ongelijkheid van vermogens en belastingdruk in box 3. Vervolgens worden verschillende varianten voor het belasten van (het rendement op) financiële vermogens uitgewerkt in paragraaf 3. Tot slot worden in paragraaf 4 de aannames die bij het uitgevoerde onderzoek zijn gebruikt nader toegelicht. Hierbij worden de gebruikte (micro)data besproken, alsmede de koppelingen tussen verschillende bestanden die daarbij plaats hebben gevonden. Ook wordt de kwantificering van een aantal variabelen die van belang zijn voor de gepresenteerde scenario’s besproken.

Authors

CPBs short-term forecasts March 2015

- Main Conclusions

- Fan Charts

- The table 'Main economic indicators', 2013-2016

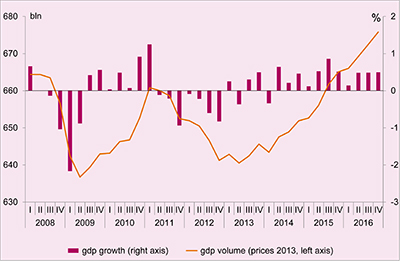

- Graph 'Economic growth in the Netherlands, 2008-2016'

- Collected Appendices CEP 2015

Main conclusions

Read the accompanying press release and the Central Economic Plan 2015, a translation of chapter 1 of the Dutch publication.

Fan Charts

Take a look at the Fan Charts.

Table 'Main economic indicators', 2013-2016

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Relevant world trade volume goods and services (%) |

2.5 |

2.4 |

4.3 |

4.9 |

| Export price competitors (goods and services, non-commodities, %) |

-2.4 |

-0.9 |

8.2 |

1.5 |

| Crude oil price (Brent, level in dollars per barrel) |

108.7 |

99.0 |

53.4 |

62.1 |

| Exchange rate (dollar per euro) |

1.33 |

1.33 |

1.13 |

1.13 |

| Long-term interest rate the Netherlands (level in %) |

2.0 |

1.5 |

0.5 |

0.5 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Gross domestic product (GDP, economic growth, %) |

-0.7 |

0.8 |

1.7 |

1.8 |

| Consumption households (%) |

-1.6 |

0.1 |

1.5 |

1.7 |

| Consumption general government (%) |

-0.3 |

-0.1 |

0.2 |

0.1 |

| Capital formation including changes in stock (%) |

-5.3 |

1.5 |

3.8 |

4.5 |

| Exports of goods and services (%) |

2.0 |

4.0 |

4.6 |

4.8 |

| Imports of goods and services (%) |

0.8 |

3.8 |

4.9 |

5.3 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Price gross domestic product (%) |

1.1 |

1.0 |

1.0 |

0.8 |

| Export price goods and services (non-energy, %) |

0.3 |

-0.2 |

1.3 |

1.3 |

| Import price goods (%) |

-1.5 |

-3.0 |

-5.2 |

3.1 |

| Inflation, harmonised index of consumer prices (hicp, %) |

2.6 |

0.3 |

-0.1 |

0.9 |

| Contractual wages market sector (%) |

1.2 |

1.1 |

1.1 |

1.4 |

| Purchasing power, static, median all households (%) |

-1.3 |

1.4 |

1.2 |

0.0 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Labour force (%) |

0.8 |

-0.5 |

0.9 |

0.9 |

| Active labour force (%) |

-0.8 |

-0.6 |

1.1 |

1.1 |

| Unemployment (in thousands of persons) |

647 |

656 |

645 |

635 |

| Unemployed rate (% of the labour force) |

7.3 |

7.4 |

7.2 |

7.0 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Production (%) |

-1.0 |

1.9 |

2.3 |

2.6 |

| Labour productivity (labour years, %) |

0.4 |

1.5 |

1.1 |

1.3 |

| Employment (labour years, %) |

-1.5 |

0.4 |

1.2 |

1.3 |

| Compensation per employee (%) |

2.6 |

2.0 |

0.5 |

2.4 |

| Labour share in enterprise income (level in %) |

81.4 |

80.4 |

78.2 |

78.4 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Private savings (% of disposable household income) |

0.6 |

2.5 |

3.1 |

1.9 |

| Current-account balance (level in % GDP) |

8.5 |

9.6 |

10.0 |

9.5 |

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| General government financial balance (% GDP) |

-2.3 |

-2.6 |

-1.8 |

-1.2 |

| Gross debt general government (% GDP) |

68.6 |

69.0 |

68.8 |

67.8 |

| Taxes and social security contributions (% GDP) |

37.2 |

37.9 |

37.6 |

38.1 |

The revision of the National Accounts by Statistics Netherlands is incorporated in this outlook.

The wage-rate market sector, labour-income share as well as private savings are biased upward for 2014, 2015 and 2016, due to the measure to limit the use of a so-called Stamrecht bv (severance pay insurance fund). Severance payments will be paid directly to the person involved, instead of into such a fund. After the revision of the National Accounts, severance payments are registered as employers' social security contributions. This translates into a non-recurring increase of the wage rate in 2014 which affects the development of the wages in the private sector well over 0.5% points.

The revision of the Labour Force Survey (Statistics Netherlands) leads to higher unemployment (47,000 in 2013) and a lower active labour force (minus 80,000 in 2013). Therefore, the unemployment rate increases by 0.6 percentage point. In the other years the differences are similar.

Economic growth in the Netherlands, 2008-2016