Publications

Author

June 24, 2021

The Child Penalty in the Netherlands and its Determinants

We find that while child care availability is correlated with lower child penalty, the immediate short-term causal effect of increasing child care availability on the earnings penalty of becoming a mother is small. By taking advantage of variation in gender norms in different population groups, we show that gender norms are strongly correlated with child penalty for mothers. →

December 17, 2019

The effects of the increase in the retirement age in the Netherlands

June 26, 2019

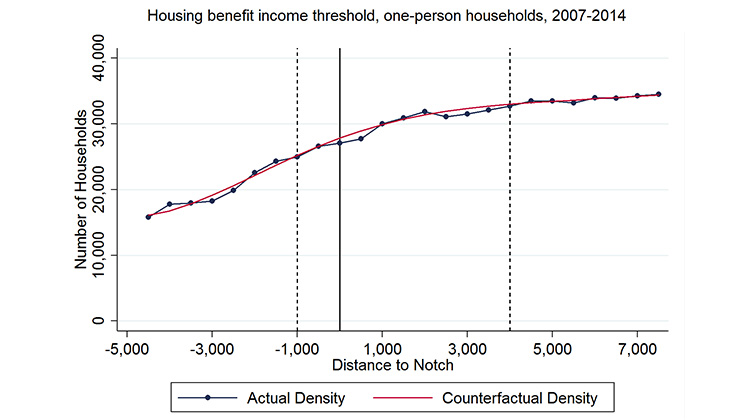

Non-Bunching at Kinks and Notches in Cash Transfers

June 12, 2019

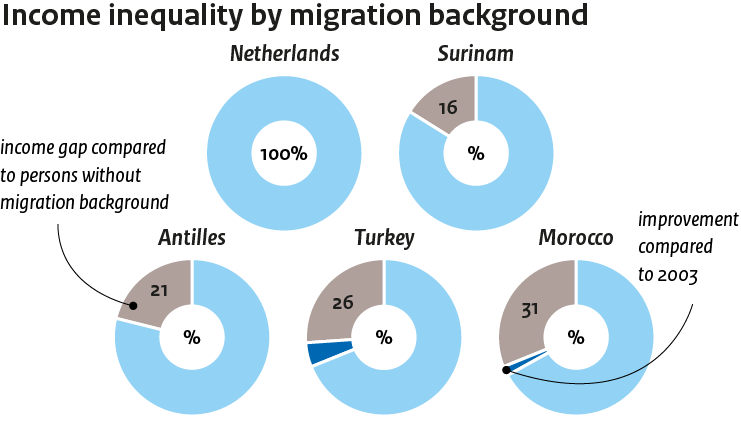

Income differences across migrant groups

February 15, 2018

Optimal Taxation of Secondary Earners in the Netherlands: Has Equity Lost Ground?

The Netherlands witnessed major reforms in the taxation of (potential) secondary earners over the past decade. Using the inverse-optimal method of optimal taxation we recover the implicit social welfare weights of single- and dual-earner couples over time. The social welfare weights are grosso modo well-behaved before the reforms. →

November 22, 2017