Publications

Author

March 21, 2024

Nowcasting GDP growth

July 13, 2022

Structural causes of low interest rates

September 7, 2021

Optimal capital ratios for banks in the euro area

Capital buffers help banks to absorb financial shocks. This reduces the risk of a banking crisis. However, on the other hand capital requirements for banks can also lead to social costs, as rising financing costs can lead to higher interest rates for customers. In this research we make an exploratory analysis of the costs and benefits of capital buffers for groups of European countries. →

February 13, 2020

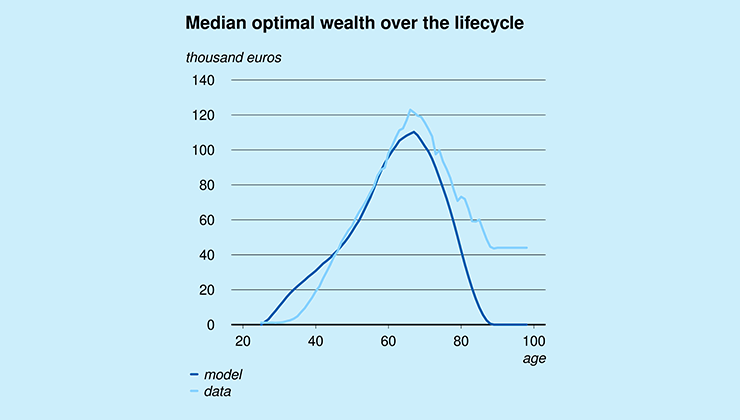

Are the savings of Dutch households optimal?

March 9, 2017