Search results

November 9, 2023

Groenere toekomst door herijking van Europese begrotingsnormen

January 27, 2023

Autonomie? Kies liever voor ‘globalanceren’

May 25, 2022

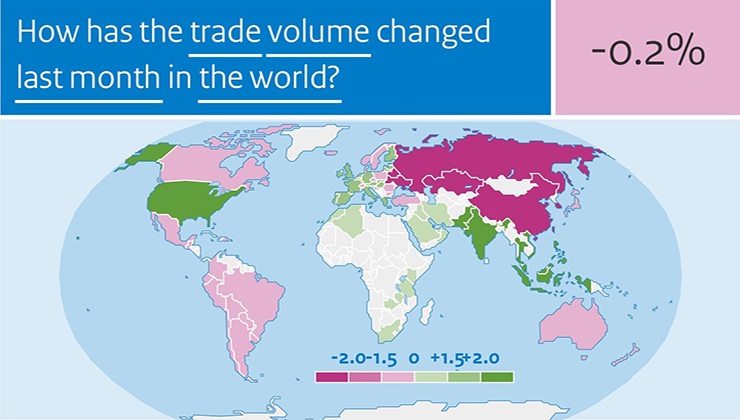

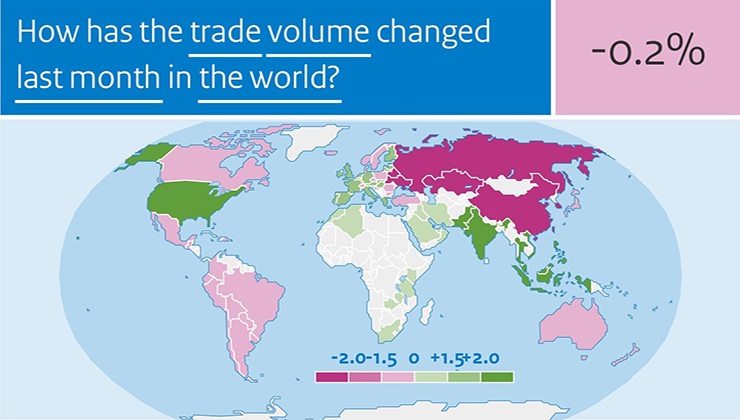

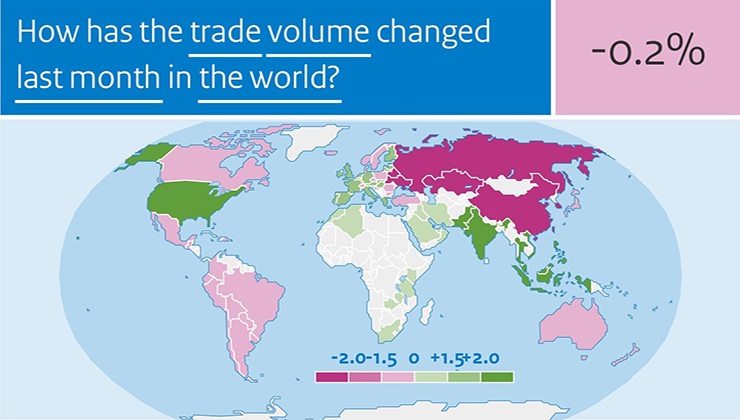

World Trade Monitor March 2022

May 25, 2022

World Trade Monitor March 2022

May 25, 2022

World Trade Monitor March 2022

May 25, 2022

World Trade Monitor March 2022

May 25, 2022

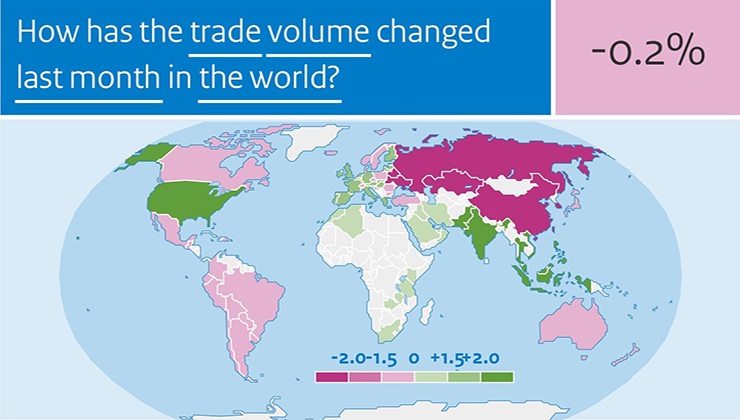

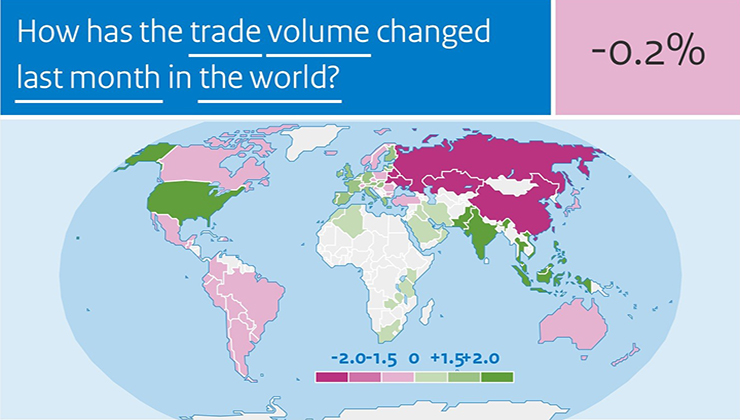

World trade dropped slightly in March

May 24, 2022

Risicorapportage Financiële markten 2022

May 24, 2022

Risicorapportage Financiële markten 2022

Publication year

Authors

- Arjan Lejour (135)

- Hugo Rojas-Romagosa (58)

- Wim Suyker (49)

- Henk Kox (44)

- Albert van der Horst (36)

- Gerdien Meijerink (33)

- Bas Straathof (32)

- George Gelauff (31)

- Michiel Bijlsma (30)

- Paul Tang (26)

- Ruud de Mooij (26)

- Adam Elbourne (25)

- Coen Teulings (23)

- Henri de Groot (23)

- Leon Bettendorf (21)

- Gerard van Welzenis (20)

- Johannes Bollen (20)

- Sjef Ederveen (19)

- Maarten van 't Riet (18)

- Richard Nahuis (18)

- Beau Soederhuizen (17)

- Mark Roscam Abbing (17)

- Gijsbert Zwart (16)

- Benedikt Vogt (15)

- Bert Smid (15)

- Douwe Kingma (15)

- Sander van Veldhuizen (15)

- Jan Möhlmann (14)

- Nico van Leeuwen (14)

- Fien van Solinge (13)

- Joeri Gorter (12)

- Paul Veenendaal (11)

- Gerard Verweij (10)

- Jos Ebregt (10)

- Machiel Mulder (10)

- Sander Lammers (10)

- Sijbren Cnossen (10)

- Casper van Ewijk (8)

- Harold Creusen (8)

- Jasper Lukkezen (8)

- Johan Verbruggen (8)

- Martin Mellens (8)

- Simon Rabaté (8)

- Wink Joosten (8)

- Bram Hendriks (7)

- Daan Freeman (7)

- Harro van Heuvelen (7)

- Kan Ji (7)

- Rob Euwals (7)

- Arie ten Cate (6)

- Bert Kramer (6)

- Jan Lemmen (6)

- Karen van der Wiel (6)

- Kasper Stuut (6)

- Katarzyna Grabska (6)

- Lu Zhang (6)

- Maurits van Kempen (6)

- Roger Smeets (6)

- Stefan Boeters (6)

- Gert Jan Linders (5)

- Raymond Montizaan (5)

- Roland de Bruijn (5)

- Rutger Teulings (5)

- Bas ter Weel (4)

- Cees Jansen (4)

- Eugene Verkade (4)

- Hein Mannaerts (4)

- Herman Noordman (4)

- Herman Stolwijk (4)

- Laura Thissen (4)

- Machiel van Dijk (4)

- Rob Luginbuhl (4)

- Stefan Groot (4)

- Suzanne Kok (4)

- Wouter Leenders (4)

- Bert Minne (3)

- Clem Capel (3)

- Dinand Webbink (3)

- Emile Cammeraat (3)

- Frits Bos (3)

- Henry van der Wiel (3)

- Marc van der Steeg (3)

- Marcel Timmer (3)

- Michiel van Leuvensteijn (3)

- Paolo Calio (3)

- Rob Aalbers (3)

- Suzanne Vissers (3)

- Wouter Elsenburg (3)

- Aad Houweling (2)

- Adri den Ouden (2)

- Alain Borghijs (2)

- Andrei Dubovik (2)

- Bart Voogt (2)

- Bas Jacobs (2)

- Clovis Hopman (2)

- Eddy Bekkers (2)

- Edwin van de Haar (2)

- Elina Ladinska (2)

- Ernest Berkhout (2)

- Francis Weyzig (2)

- Show all

Tags

- International economy (863)

- International analysis (854)

- Macroeconomics (240)

- Public finances (231)

- Government (99)

- Risk and regulation (87)

- Financial markets (64)

- Labour (52)

- Labour market (52)

- COVID-19 (46)

- Knowledge and Innovation (42)

- Education and Science (34)

- Globalisation and regional differences (32)

- Competition and regulation (28)

- General welfare (23)

- Welfare state (23)

- Built environment (20)

- Physical environment (20)

- Digital economy (8)

- purchase power (8)

- Productivity (7)

- Model quality (6)

- Taxation (4)

- Health care (2)

- Corona COVID-19 (1)

- Show all