Search results

July 13, 2022

Structural causes of low interest rates

January 20, 2022

Vermogensongelijkheid: een complex probleem

August 27, 2020

Lage rente en de toekomst van pensioenen

February 13, 2020

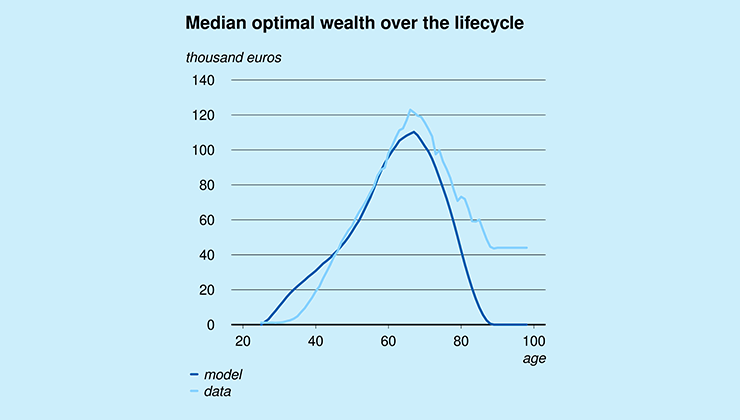

Are the savings of Dutch households optimal?