Publications

November 7, 2022

Wealth, gifts, and estate planning at the end of life

We show that gifts made to heirs before death are substantial and highly responsive to taxation. Therefore, characterising them and understanding their determinants is crucial for tax design. We use high-quality, intergenerationally-linked data on wealth, gifts, and medical expenses from the Netherlands. →

March 25, 2022

Inequality and Redistribution in the Netherlands

June 26, 2019

Dutch Shell Companies and International Tax Planning

June 26, 2019

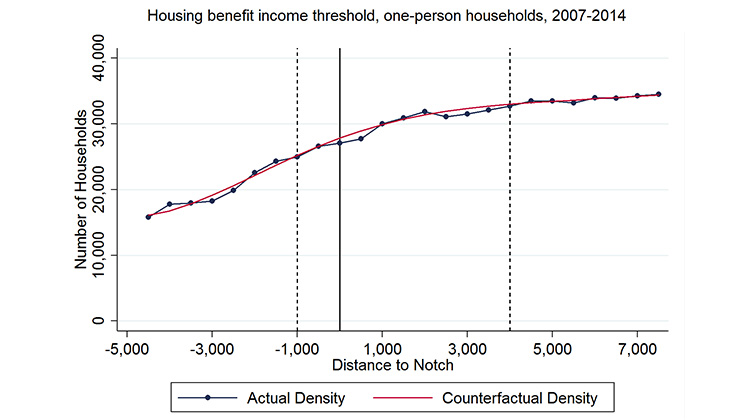

Non-Bunching at Kinks and Notches in Cash Transfers