The changing landscape of firm financing in Europe, the United States and Japan

We find four groups of EU countries, namely market-based countries, bank-based countries, Eastern European countries and outliers – countries with disproportionally large financial sectors in relation to their country size. Our classification is consistent with that of Bijlsma and Zwart (2013) for 2006, suggesting a strong persistence of financial structures in Europe over time.

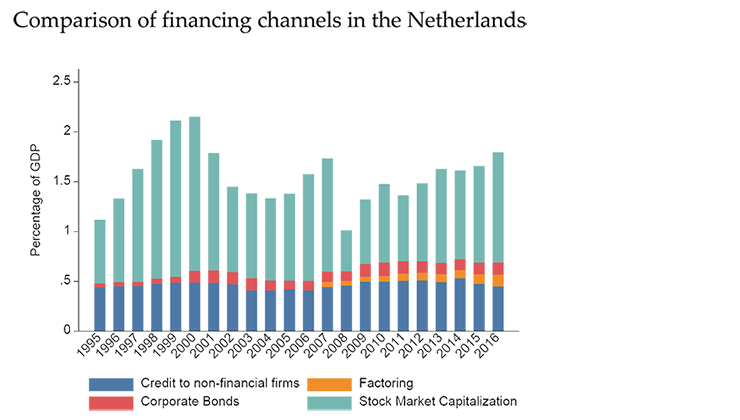

We then discuss the development of a wide range of financial indicators before and after the 2007/8 global financial crisis. We observe a considerable decline in bank credit to non-financial firms, especially in bank-based and Eastern European countries. Furthermore, we see a shift in the capital market away from equity financing towards bond financing, especially in market-based EU countries and the US. The growth of alternative forms of financing is rapid. However, their size remains relatively small as a percentage of GDP.

For the Netherlands, we observe a moderate increase in market financing and strong growth of alternative forms of financing such as factoring. Our research provides a useful comparative tool of the financial sector across Europe for policy makers.