Publications

Author

- Gerdien Meijerink (18)

- Rutger Teulings (13)

- Daan Freeman (12)

- Leon Bettendorf (12)

- Maarten van 't Riet (11)

- Egbert Jongen (10)

- Peter Zwaneveld (10)

- Rudy Douven (10)

- Adam Elbourne (9)

- Arjan Lejour (9)

- Harro van Heuvelen (9)

- Andrei Dubovik (8)

- Beau Soederhuizen (7)

- Benedikt Vogt (7)

- Kan Ji (7)

- Mark Kattenberg (7)

- Rob Luginbuhl (7)

- Simon Rabaté (7)

- Stefan Boeters (7)

- Bastiaan Overvest (6)

- Jan Möhlmann (6)

- Joep Tijm (6)

- Marielle Non (6)

- Wiljan van den Berge (6)

- Karen van der Wiel (5)

- Maria Zumbuehl (5)

- Milena Dinkova (5)

- Minke Remmerswaal (5)

- Paul Verstraten (5)

- Ramy El-Dardiry (5)

- Bas Scheer (4)

- Benjamin Wache (4)

- Bert Smid (4)

- Frits Bos (4)

- Henk-Wim de Boer (4)

- Jan Boone (4)

- Johannes Bollen (4)

- Jonneke Bolhaar (4)

- Lu Zhang (4)

- Nicoleta Ciurila (4)

- Roel van Elk (4)

- Sonny Kuijpers (4)

- Annemiek Verrips (3)

- Arjan Trinks (3)

- Bram Wouterse (3)

- Brinn Hekkelman (3)

- Ed Westerhout (3)

- Fien van Solinge (3)

- Gerard Verweij (3)

- Gerbert Romijn (3)

- Hugo Rojas-Romagosa (3)

- Jennifer Buurma-Olsen (3)

- Koen van Ruijven (3)

- Loes Verstegen (3)

- Natasha Kalara (3)

- Nicole Bosch (3)

- Patrick Koot (3)

- Rinske Windig (3)

- Tijl Hendrich (3)

- Anja Deelen (2)

- Bas Straathof (2)

- Bert Kramer (2)

- Bram Hendriks (2)

- Emile Cammeraat (2)

- Esther Mot (2)

- Harry ter Rele (2)

- Henk Kranendonk (2)

- Jan-Maarten van Sonsbeek (2)

- Joep Steegmans (2)

- Joris de Wind (2)

- Jurre Thiel (2)

- Konstantin Sommer (2)

- Krista Hoekstra (2)

- Maaike Diepstraten (2)

- Marente Vlekke (2)

- Merve Mavus Kütük (2)

- Pim Kastelein (2)

- Raoul van Maarseveen (2)

- Remco van Eijkel (2)

- Rik Dillingh (2)

- Rob Aalbers (2)

- Rob Euwals (2)

- Sander Gerritsen (2)

- Sander Hoogendoorn (2)

- Sander Lammers (2)

- Sander van Veldhuizen (2)

- Suzanne Vissers (2)

- Thomas van der Pol (2)

- Wim Suyker (2)

- Adelina Sharipova (1)

- Albert van der Horst (1)

- Alexandra Rusu (1)

- Ali Palali (1)

- Alice Zulkarnain (1)

- Anne Marieke Braam (1)

- Anne-Fleur Roos (1)

- Annikka Lemmens (1)

- Arjen Hussem (1)

- Arne Brouwers (1)

- Bart Voogt (1)

- Ben Dahmen (1)

- Bert van Stiphout-Kramer (1)

- Carolijn de Kok (1)

- Casper Vedder (1)

- Céline van Essen (1)

- Clemens Fiedler (1)

- Corjan Brink (PBL) (1)

- Corjan Brink, PBL (1)

- Daniel van Vuuren (1)

- Derk Visser (1)

- Diederik Dicou (1)

- Dinand Webbink (1)

- Douwe Kingma (1)

- Emiel van Bezooijen (1)

- Emma van de Meerendonk (1)

- Erik van de Winkel (1)

- Ernest Berkhout (1)

- Eugene Verkade (1)

- Eva van der Wal (1)

- Fozan Fareed (1)

- Francis Weyzig (1)

- Gabriella Massenz (1)

- Giulia Piccillo (1)

- Hans Koster VU (1)

- Hans Koster, VU (1)

- Henrik Zaunbrecher (1)

- Herman Vollebergh, PBL (1)

- Iris van Tilburg (1)

- Jason Rhuggenaath (1)

- Jort Sinninghe Damsté (1)

- Jos Ebregt (1)

- Jos van Ommeren VU (1)

- Jos van Ommeren, VU (1)

- Judith Bayer (1)

- Julie Tréguier DIW (1)

- Jurriaan Paans (1)

- Katharina Ziegler (1)

- Kati Gaspar (1)

- Konstantinos Velentzas (1)

- Laura van Geest (1)

- Leonie Gercama (1)

- Lily Davies (1)

- Lisette Swart (1)

- Loe Franssen (CBS) (1)

- Lucas Smits (1)

- Machiel van Dijk (1)

- Marcel Lever (1)

- Marianne Tenand (1)

- Mark van der Plaat (1)

- Martin Mellens (1)

- Matthijs Katz (1)

- Maud Hofland (1)

- Maurits van Kempen (1)

- Maxime Tô IPP (1)

- Michael Polder (CBS) (1)

- Michael Polder (Statistics Netherlands (1)

- Michael Polder (Statistics Netherlands) (1)

- Michiel Bijlsma (1)

- Nicole Loumeau (1)

- Nihal Chehber (1)

- Ona Ciocyte (1)

- Oscar Lemmers (CBS) (1)

- Pieter Hasekamp (1)

- Remco Mocking (1)

- Robert Schmitz (1)

- Robin Konietzny (CBS) (1)

- Ron van der Heijden (1)

- Sem Duijndam (1)

- Stan Olijslagers (1)

- Stanley Wagteveld (1)

- Tatiana Kiseleva (1)

- Thijs Benschop (1)

- Thomas Kooiman (1)

- Thomas Michielsen (1)

- Tilbe Atav (1)

- Tobias Vervliet (1)

- Ton Manders (1)

- Vince van Houten (1)

- Willem van der Wal (1)

- Wouter Leenders (1)

- Xinyu Li (PBL) (1)

- Show all

May 1, 2025

Economic effects of import tarrifs

April 9, 2025

Dutch firms in international production chains

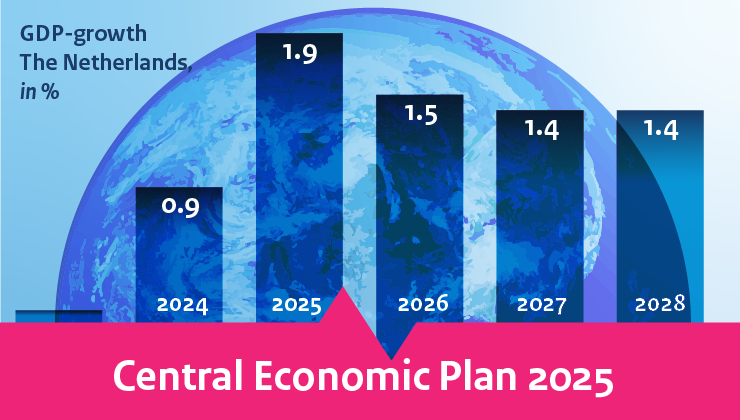

February 26, 2025

Projections February 2025 (CEP 2025)

February 14, 2025

National Productivity Board 2024

February 13, 2025

The Effect of Adverse Life-Events on Income Trajectories

February 11, 2025

Cycling cities: Mode choice, car congestion, and urban structure

December 12, 2024

Responses to cost-sharing: Do socio-demographic characteristics matter?

November 28, 2024

Effects of US Import Tariffs on the Dutch and European Economy