Roads to recovery, chapter 8: Three roads to recovery

- The Dutch economy is resilient, but the recovery of aggregate demand will take time.

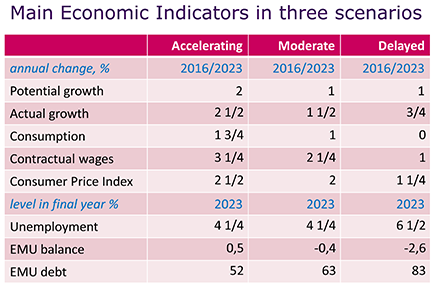

- Depending on strong or weak supply, over the next decade the Dutch economy may grow by 1½% (Moderate Recovery) to 2½% (Accelerated Recovery) per year.

- When substantial demand risks materialise the economy will not recover in the coming decade and government debt deteriorates (Delayed Recovery).

The Great Recession has hit the Dutch and European economies hard, but they can recover. Labour productivity can grow again just as fast as before the crisis, consumption can recover and unemployment will gradually decline. This will benefit the government through a lower budget deficit and lower debt. However, this recovery could be nipped in the bud if households and governments in the Netherlands and Europe focus on saving and spend little.

This chapter expands on this perspective by describing three scenarios, which together paint a picture of economic development in the next decade. The first determining factor for economic developments is the productive capacity in the Netherlands and Europe. Technological progress has been temporarily inhibited by the crisis, but can recover in the coming years. How quickly technology will develop is uncertain. Before the crisis, labour productivity in the Netherlands grew by an average 1.4% per year. In the scenarios we assume a potential labour productivity growth of 1 to 1 ¾% in the next decade. In addition to technological developments, the other important factor for productive capacity is employment. In the coming years, economic growth will come mainly from the recovery of the labour market with unemployed and discouraged workers getting back to work. Due to the ageing population and slowing growth of women's participation in the labour force, the labour supply will barely grow.

Domestic and foreign spending is the second determining factor in the development of the economy over the next decade. These expenditures depend primarily on disposable income. If production growth is high household income will be large and allow faster consumption growth. Government revenue will also increase, which they can use for debt repayment, tax cuts or extra spending. The second important factor is the development of wealth. If wealth barely recovers, for example because house prices do not grow or even decline further, households will have to save more to overcome their problems with negative equity. Disappointing demand from households and governments may therefore delay the economic recovery.

In 'accelerating recovery' scenario, the economy grows robustly by 2½% per year. The labour market recovers and unemployment falls towards 4%. Household income is high and the need to save limited, so consumption grows by 1¾%. In the 'moderate recovery' scenario the labour market also recovers, but production and expenditure grow and at a lower level, with an average economic growth rate of 1½%. In the 'delayed recovery' scenario governments (in Europe) and households (both domestic and foreign) apply the brakes. With the consumption of Dutch households not growing, the economic growth that does occur comes largely from abroad. The government deficit in this scenario remains around 3% and the national debt is rising, while the opposite happens in the moderate and accelerating recovery scenarios.