Roads to recovery

CPB publishes book about the possibilities of economic recovery

This is concluded by authors George Gelauff, Debby Lanser, Albert van der Horst and Adam Elbourne in the CPB Book Roads to Recovery, published today.

The book identifies the indications that point towards the ‘roads to recovery’. The authors present the building blocks of three possible scenarios for economic development in the Netherlands over the coming decade, based on in-depth analyses of the financial markets, the housing market, the labour market, productivity and consumption levels, and the current situation in Europe.

The Great Recession’s characteristics of low growth and high unemployment levels are not permanent. The Dutch economy is resilient; productivity growth can return to pre-recession levels, depending on technological and international developments. Employment can increase and unemployment levels may recover to the point of equilibrium. Such a recovery, however, will take time and risks will also remain, causing consumer and government spending to stay under pressure for a long time to come.

Recovery of the financial markets as well as the housing market is vitally important. Consumer and corporate credit limitations will be reduced once confidence in the financial sector is restored. Increasing inflation and rising house prices both contribute to the alleviation of the pressure of household and government debt. The pace of the recovery will largely depend on the timing of these economic feedback mechanisms.

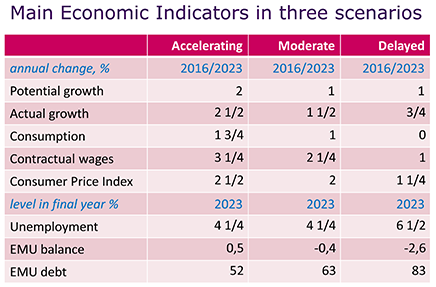

To explain the various options, three scenarios were developed for the ‘Roads to Recovery’ study. Under the 'Increasing Recovery' scenario, the economy shows rapid growth, which leads to labour market recovery. In this booming economy, supply and demand enhance each other. Under the 'Moderate Recovery' scenario, economic growth also recovers, but not as strongly. It requires more patience on the labour market. Under the 'Delayed Recovery' scenario, the financial and housing market issues have not been resolved. Government and consumer demand will remain low, and limited global growth curbs international spending. Under this scenario, recovery will take a long time to occur and thus unemployment also will remain high.

Recovery of the financial sector, the labour market and the housing market? Originating from resilience of the European and Dutch economies? Leading to the return of pre-crisis consumption growth? Recovery is a plausible road for the economies of Europe and the Netherlands in the next decade. But it’s not the only road. Continuing demand shortfalls may delay the recovery.

Roads to recovery focuses on the Dutch economy in a European context. The book reviews the impact of the Great Recession and paints a picture of the economy today. It gives an outlook into the next decade by means of three scenarios for the European and Dutch economies.

Read also the Background Document 'The Dutch labour market during the Great Recession'.

Downloads

Authors