Do zero and sign restricted SVARs identify unconventional monetary policy shocks in the euro area?

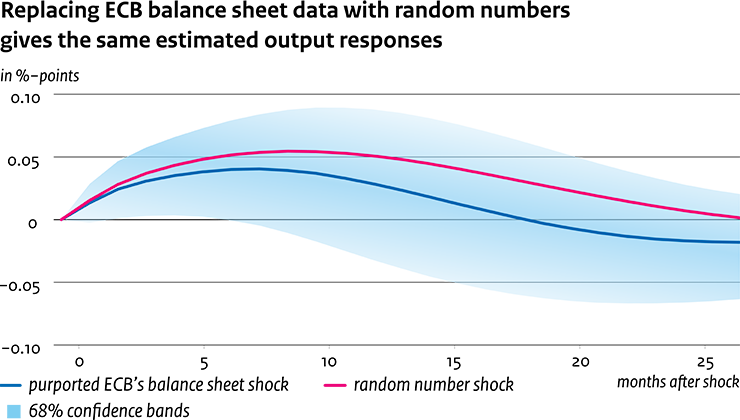

As a consequence, it is implausible that the shocks previously identified in the literature are true unconventional monetary policy shocks. Since correctly isolating unconventional monetary policy shocks is a prerequisite for subsequently estimating the effects of unconventional monetary policy shocks, the conclusions from previous vector autoregression models are unwarranted. We show this lack of identification for different specifications of the vector autoregression models and different sample periods.

Downloads

To overcome this identification problem our research uses an alternative technique for isolating unexpected changes in monetary policy based on futures rate data. Using data on monetary surprises from Jarociński and Karadi (2018) and this alternative technique we do not find statistically significant evidence that unconventional monetary policy shocks have affected economic activity and only very weak evidence for an effect on prices.

In an earlier CPB Discussion Paper 371 'The effects of unconventional monetary policy in the euro area', we concluded that expansionary unconventional monetary policy shocks had stimulated economic activity in the euro area, although the estimates were only weakly significant. This was based on a vector autoregressive regression with zero and sign restrictions - a well-accepted methodology in the literature. However, the new Discussion Paper shows that, like the other results reported in the literature using vector autoregressions, our previous results are not reliable. Other methods are required to analyse the causal effect of unconventional monetary policy on the economy.

Read also CPB Discussion Paper 407 'SVARs, the central bank balance sheet and the effects of unconventional monetary policy in the euro area' (December 2019).

Authors