Conduit country the Netherlands in the spotlight

The Netherlands is an important link in the chain of diverting income flows: broader use of withholding taxes is necessary to combat international tax avoidance

To include these countries under the withholding tax, a broader application is needed. This can be done with a withholding tax that is conditional on the tax that is actually paid in the direct destination country. For the effective combating of tax avoidance, international coordination of tax legislation remains necessary, because the Netherlands is only one link in a complex, financial chain.

Downloads

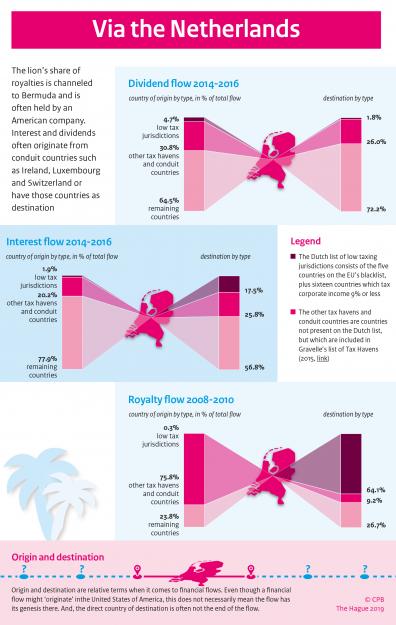

The Netherlands is a conduit country. The value of participations, loans and intellectual property rights of Dutch Special Purpose Entities (SPEs) add up to 4200 billion euro in 2016. The SPEs are the international link between subsidiaries of Multi National Enterprises (MNEs), in countries of origin and destination. These SPEs record dividends, interest and royalties flowing through the Netherlands amounting up to 200 billion euro yearly.

Tax havens are an important destination for royalties, with a share of about 60% in the outgoing flows. This involves especially Bermuda. For outgoing interest, the share of tax havens is smaller, varying from 20% to 45%, depending on the chosen definition of tax havens. The broader definition also contains conduit countries like Ireland, Luxemburg and Switzerland. For incoming dividends, the share of tax havens varies between 5% and 35%. For interest and dividends, the share of conduits is substantial, as origin and as destination, in the range of 20% to 30%. This demonstrates that the diversion of financial flows is complex, involving several conduits and often also tax havens at the start or end of the route; the Netherlands is but one link in the chain.

Since the Netherlands does not, up until now, levy a withholding tax on royalties, the tax savings MNEs can make with a Dutch SPE are substantial. The planned withholding tax on flows to low tax jurisdictions from 2021 will eliminate this tax avoidance via the Netherlands.

We cannot find, based on statutory rates of the corporate income and withholding taxes, substantial tax savings for interest and dividends. However, the conduit countries involved, do not have low statutory tax rates, but the income flows will often not be taxed, or not effectively, because the income is channelled to other countries. The direct destination is often found not to be the residence of the MNE. This applies in particular to American MNEs, which form about one third of the ultimate beneficial owners.

A conditional withholding tax based on the effective tax rates of the direct destination countries, instead of being based on statutory tax rates, will be more effective in combatting tax avoidance via the Netherlands. Moreover, the complexity of the routes emphasizes the necessity of international coordination of tax legislation.

Authors