Estimation of the Financial Cycle with a Rank-Reduced Multivariate State-Space Model

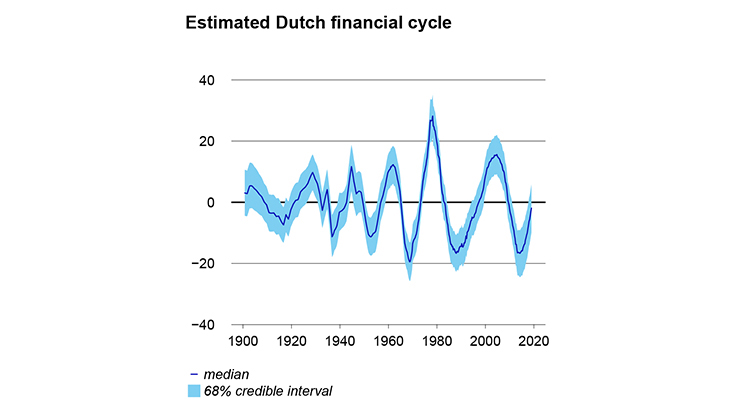

We identify a single financial cycle from the multiple time series by imposing rank reduction on this cycle component. The rank reduction can be justified based on a principal components argument. The model also includes unobserved components to capture the business cycle, time-varying seasonality, trends, and growth rates in the data. In this way we can control for these effects when estimating the financial cycle. We apply our model to US and Dutch data and conclude that a bivariate model of credit and house prices is sufficient to estimate the financial cycle.

Downloads

Inmiddels hebben wij al aanwijzingen gevonden dat de financiële cyclus invloed heeft op de effectiviteit van begrotingsbeleid: De impact van de financiële cyclus op begrotingsbeleid.

In dit onderzoek wordt de dynamiek van de financiële cyclus bepaald door een trigonometrische cycluscomponent. We identificeren één financiële cyclus op basis van meerdere tijdreeksen door rangreductie op te leggen aan deze cycluscomponent. Het model bevat ook andere componenten om de invloeden van de conjunctuurcyclus, seizoensinvloeden, trends en groeivoeten te kunnen opvangen. Op deze manier kunnen we voor deze effecten controleren bij het schatten van de financiële cyclus. We passen ons model toe op Amerikaanse en Nederlandse data en concluderen dat een model op basis van krediet en huizenprijzen voldoende is om de financiële cyclus te schatten.

Authors