Search results

10th Health Policy Workshop "Benchmarking Nursing Homes"

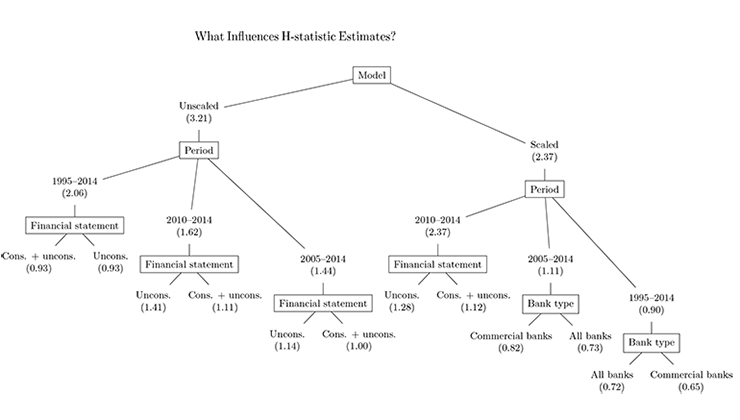

Can we measure banking sector competition robustly?

Certificering budgettaire ramingen nota’s van wijziging najaar 2018

Deze CPB Notitie certificeert de ramingen van de fiscale beleidsmaatregelen uit de nota’s van wijziging naar aanleiding van de heroverweging vestigingsklimaat en de nota van wijziging ATAD-uitzondering PPS (publiek-private samenwerkingen). Het CPB acht de ramingen van de budgettaire effecten van de maatregelen redelijk en neutraal. →

Netherlands Economists Day and KVS Tinbergen-lecture

Workshop: On the Relation between the Dutch Housing Market and Household Consumption

Programme:

13.00 – 13.05 Short introduction (Michiel Bijlsma, Head of Department Competition & Regulation, CPB)

13.05 - 13.20 On the correlation between consumption and house prices in the Netherlands (Bahar Öztürk, DNB)

13.20 - 13.35 Household debt and consumption during the crisis. What can we learn from Dutch data? (Rutger Teulings, CPB)

13.35 – 13.50 Do house prices matter for household consumption? (Lu Zhang, CPB)

13.50 -14.05 On the link between increasing house prices, mortgage debt and consumtion (Christian Lennartz, RaboResearch)

14.15 – 14.30 Q&A

1) On the correlation between consumption and house prices in the Netherlands

Bahar Öztürk, DNB

According to an international comparative analysis, the Netherlands is one of a group of countries with a relatively strong relationship between house prices and private consumption. The strength of this relationship mainly depends on the relative share of homeowners with a mortgage loan. This suggests that institutional differences between mortgage markets (e.g. in the tax treatment of mortgage interest rates) probably play a substantial role in explaining why the relationship between house prices and private consumption is so much stronger in some countries.

2) Household debt and consumption during the crisis. What can we learn from Dutch data?

Kan Ji, Rutger Teulings & Bram Wouterse (all CPB)

We estimate the contemporaneous relationship between household debt and household consumption, both scaled by income, for the period 2006 to 2015. We use a proxy measure of consumption based on administrative data for the whole Dutch population. On the micro level, we find that the average consumption of households with high debt has decreased much sharper during the crisis than that of other households. This drop is strongest for households who used new debt to move to a different address. Before the crisis, these households seem to have used part of their debt to finance one-off high consumption (e.g. durables). After the crisis households' ability or willingness to use debt for this purpose decreased: the number of movers with high debt became smaller, and their consumption level decreased. On the macro level, however, this group plays only a minor role in explaining the drop in consumption because of its relatively limited size. Instead, the number of high indebted home owners who do not move and have negative home equity increases substantially during the crisis. As a result, the more modest drop in consumption on a micro level of this group has a more substantial effect on the macro level. This suggests that precautionary savings (or borrowing constraints) among highly indebted households partly explain the consumption decline during the crisis.

3) Do house prices matter for household consumption?

Lu Zhang (CPB)

To what extent do large swings in house prices drive household consumption? Using a large panel of Dutch households over the period 2007 to 2014, I find a significant positive relationship between house prices and household (durable) consumption. A 10% change in home values leads to a 0.68% change in household consumption for homeowners, but a negligible response for renters. Young and middle-aged homeowners have larger consumption sensitivities to house prices than old households. Delving into the underlying channels, I find strong evidence that house prices affect consumption through the borrowing collateral channel and not the pure wealth effect channel.

4) De link tussen stijgende huizenprijzen, hypotheekschuld en consumptieve bestedingen

Lisan Spiegelaar & Christian Lennartz (Rabobank)

We make use of anonymized micro-data from Rabobank to investigate the link between house price appreciations and private consumption. We show that Dutch home owners with a mortgage consume about 4 cents of each Euro their house appreciates in value in the period from 2014-16. The total mortgage debt does not have an effect on this relation. We do observe regional differences: In provinces with stronger house price appreciations the marginal propensity to consume is higher. Home owners in ‘North-Holland’ consume about 6 cent of each Euro the house gained in value.

→Verdringing op de arbeidsmarkt, beschrijving en beleving

Verdringing is een begrip dat mensen vaak en snel in de mond nemen en waar ook veel meningsverschil en spraakverwarring over bestaat. Het is geen neutraal begrip; het klinkt negatief. De één neemt de baan in van een ander en dat impliceert voor veel mensen een probleem. Maar wat als die ander na verloop van tijd een andere baan vindt, spreken we dan nog steeds van verdringing? Of wat als de baan van de één niet altijd in de plaats komt van de baan van een ander? Daarom is inzicht in het bestaan van verdringing en de mechanismen essentieel. →

Publication year

Authors

- Peter Zwaneveld (12)

- Patrick Koot (11)

- Maurits van Kempen (10)

- Sander van Veldhuizen (8)

- Kees Folmer (6)

- Marcel Lever (6)

- Sonny Kuijpers (6)

- Gerard Verweij (5)

- Gerbert Romijn (5)

- Gerdien Meijerink (5)

- Henk-Wim de Boer (5)

- Joep Tijm (5)

- Jonneke Bolhaar (5)

- Koen van der Ven (5)

- Mark Kattenberg (5)

- Paul Verstraten (5)

- Rik Dillingh (5)

- Rob Euwals (5)

- Thomas Michielsen (5)

- Aenneli Houkes - Hommes (4)

- Anja Deelen (4)

- Annemiek Verrips (4)

- Benedikt Vogt (4)

- Egbert Jongen (4)

- Kan Ji (4)

- Remco van Eijkel (4)

- Rudy Douven (4)

- Andrei Dubovik (3)

- Arjan Lejour (3)

- Bastiaan Overvest (3)

- Bert Smid (3)

- Frits Bos (3)

- Harro van Heuvelen (3)

- Iris van Tilburg (3)

- Johannes Bollen (3)

- Jos Ebregt (3)

- Karen van der Wiel (3)

- Krista Jansema-Hoekstra (3)

- Leon Bettendorf (3)

- Maaike Diepstraten (3)

- Minke Remmerswaal (3)

- Natasha Kalara (3)

- Rinske Windig (3)

- Rob Aalbers (3)

- Sander Hoogendoorn (3)

- Tijl Hendrich (3)

- Wouter Vermeulen (3)

- Anne Marieke Braam (2)

- Bas Scheer (2)

- Beau Soederhuizen (2)

- Ben Vader (2)

- Daniël van Vuuren (2)

- Esther Mot (2)

- Hugo Rojas-Romagosa (2)

- Jochem Zweerink (2)

- Koen van Ruijven (2)

- Lu Zhang (2)

- Machiel van Dijk (2)

- Marielle Non (2)

- Martin Mellens (2)

- Raoul van Maarseveen (2)

- Rob Luginbuhl (2)

- Rutger Teulings (2)

- Sander Gerritsen (2)

- Stefan Groot (2)

- Yvonne Adema (2)

- Adam Elbourne (1)

- Albert van der Horst (1)

- Annette Zeilstra (1)

- Bart Voogt (1)

- Bram Wouterse (1)

- Carl Koopmans (1)

- Christine Carabain, Andries van den Broek (SCP) (1)

- Debby Lanser (1)

- Douwe Kingma (1)

- Ed Westerhout (1)

- Eduard Ponds, Bastiaan Starink (Netspar) (1)

- Emilie Bartels (1)

- Ernest Berkhout (1)

- Freek Ruesink (1)

- Harry ter Rele (1)

- Jan Möhlmann (1)

- Joost Veenstra (1)

- Jurriaan Paans (1)

- Katharina Ziegler (1)

- Krista Hoekstra (1)

- Lisette Swart (1)

- Marente Vlekke (1)

- Marloes de Graaf-Zijl (1)

- Michiel Bijlsma (1)

- Monique de Haard (1)

- Nicole Bosch (1)

- Olav-Jan van Gerwen, Kees Vringer, Gusta Renes (PBL) (1)

- Ralph Stevens (1)

- Roel van Elk (1)

- Sem Duijndam (1)

- Taco Prins (1)

- Thijs Oostveen (1)

- Thomas van der Pol (1)

- Wiljan van den Berge (1)

- Show all

Tags

- Macroeconomics (47)

- Public finances (46)

- General welfare (29)

- Built environment (19)

- Welfare state (17)

- Government (14)

- Labour (14)

- International analysis (13)

- International economy (12)

- Knowledge and Innovation (12)

- Labour market (12)

- Health care (10)

- Education and Science (9)

- Financial markets (9)

- Physical environment (9)

- Risk and regulation (9)

- Climate and Environment (5)

- Productivity (5)

- Digital economy (4)

- Globalisation and regional differences (2)

- Sustainability and circular economy (2)

- inflation (2)

- purchase power (2)

- Competition and regulation (1)

- Cost-benefit analyses (1)

- Elections (1)

- Local government (1)

- Migration and integration (1)

- Taxation (1)

- Show all