Search results

April 26, 2023

New Tools for Value Chain Analysis

September 7, 2021

Optimal capital ratios for banks in the euro area

Capital buffers help banks to absorb financial shocks. This reduces the risk of a banking crisis. However, on the other hand capital requirements for banks can also lead to social costs, as rising financing costs can lead to higher interest rates for customers. In this research we make an exploratory analysis of the costs and benefits of capital buffers for groups of European countries. →

September 7, 2020

De gevolgen van de coronacrisis voor Nederlandse bedrijven en banken

September 7, 2020

Analyse van kwetsbare bedrijven en banken in de coronacrisis

February 18, 2020

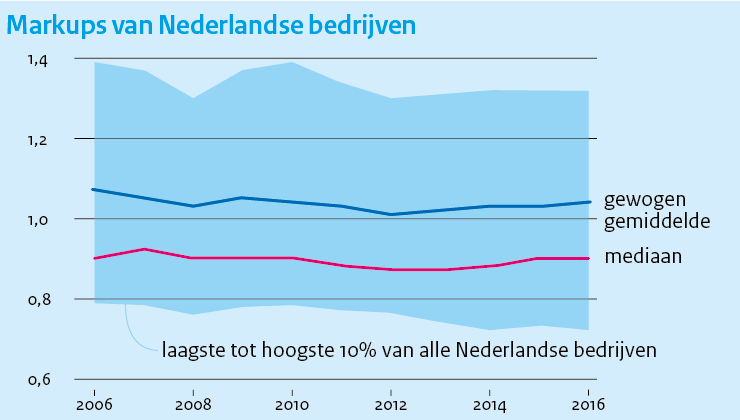

Markups in a dual labour market: the case of the Netherlands

February 13, 2020

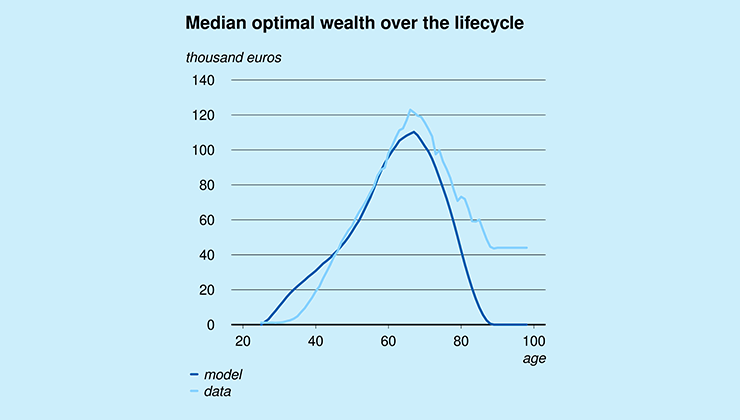

Are the savings of Dutch households optimal?

March 18, 2019

Markups van bedrijven in Nederland

Authors

- Harro van Heuvelen (14)

- Gerdien Meijerink (9)

- Leon Bettendorf (8)

- Beau Soederhuizen (3)

- Bert Kramer (3)

- Daan Freeman (3)

- Rob Luginbuhl (3)

- Rutger Teulings (2)

- Sander Lammers (2)

- Stefan Boeters (2)

- Bas Scheer (1)

- Benedikt Vogt (1)

- Bert Smid (1)

- Jan Möhlmann (1)

- Kees Folmer (1)

- Maarten van 't Riet (1)

- Nicoleta Ciurila (1)

- Rob Euwals (1)

- Simon Rabaté (1)

- Sonny Kuijpers (1)

- Yvonne Adema (1)

- Show all